Asset management

SDG driven fund selection: primary funds & co investments.

- Implementing alternative investment strategies for Private equity, VC capital, private debt, energy and infrastructure.

- Emphasis and focus on SDG driven green, sustainable & renewable strategies with regard funds; both primairy as secondary including co-investments

- All facets of due diligence on funds and direct co-investment opportunities upto extensive investment proposal for the investment committee

- Execution of the selection process in close & transparent cooperation with the client and it’s investment committee members to enhance learning curve’s incl. extensive reporting requirements.

- Institutional expertise to help build a diversified, risk mitigated alternative investment portfolio .

3 private equity portfolio themes

- The 3 Investment themes are driving your portfolio construction but can be altered in any way in close cooperation with you.

- Extensive portfolio diversification guidelines apply in an institutionalised manner

Our generation has borrowed Planet Earth from future ones. Economic and population growth, depletion of resources and climate put pressure on this ‘intergenerational lending relationship’.

More than ever sustainable growth and efficient usage of available resources are key.

Private equity fund allocations could be made to the following key sectors:

1: agri-food;

2: renewable energy;

3: water/waste treatment;

4: recycling/sorting of materials;

5: irrigation/desalination

6: Cleantech

7: Medtech;

8: Biotech;

Economic growth in emerging economies is outpacing growth in developed markets.

In contrast with the past we now see that in many of the emerging countries the percentage of the populations in what could be labeled a ‘Middle Class’ is now rapidly growing.

Private equity fund allocations could be made to the following key sectors:

1 Agri-Food

2 Real Estate

3 Asset Management

4 Education

5 Healthcare

6 TMT

7 Luxury & Leisure

8 Internet

9 Logistics

10 Fashion

This Theme bridges the gap between the standard first stage impact investments of development banks (IFC, World Bank, African Development Bank, FMO and the like) and the growth strategies of already established, larger and more mature companies.

We only select fund investments that are de-risked by professional financing rounds through global development banks of other pure impact investors (with corresponding lower returns).

We act as the natural follow-up investors and will be the catalyser promising smaller companies in regions to benefit.

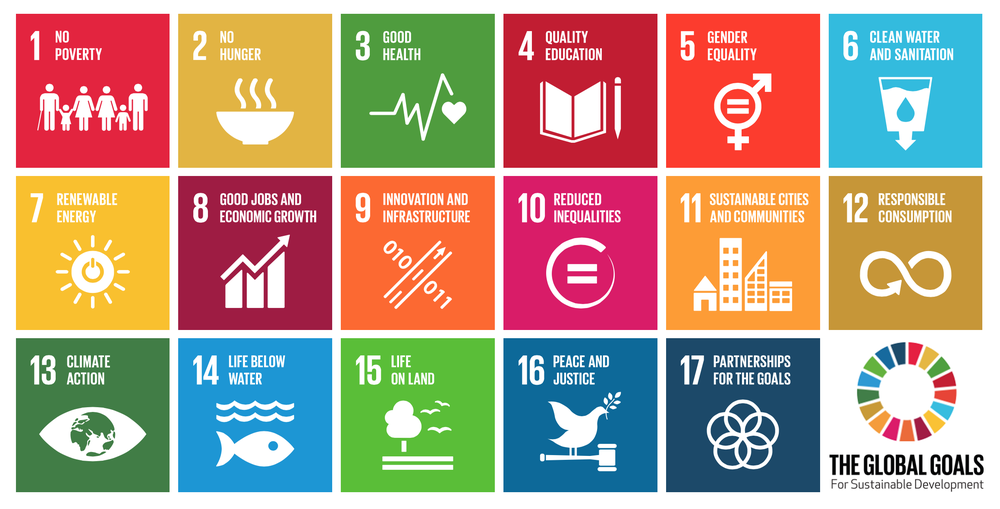

Private equity fund allocations could be made according the following selected sustainable development goals (SDGs) of the United Nations):

1) the fight against poverty (SDG1);

2) hunger relief (SDG2);

3) health improvements (SDG3);

4) better education (SDG4);

5) decent employment for all (SDG8);

6) responsible consumption (SDG12); and

8) peace (SDG16).

Other Asset management services

- Develop independent buy/sell/hold analyses for the stakeholders

- Provide market pricing for targeted funds

- Evaluate all liquidity options including secondairies, restructuring and portfolio dissolutions.

- Maximizing value by efficient managing a thorough sale process

Get in touch

Other Asset management services

- Develop independent buy/sell/hold analyses for the stakeholders

- Provide market pricing for targeted funds

- Evaluate all liquidity options including secondairies, restructuring and portfolio dissolutions.

- Maximizing value by efficient managing a thorough sale process